Awe-Inspiring Examples Of Tips About What Is The Difference Between PQ And PV

Understanding PQ and PV

1. Peeling Back the Layers of PQ and PV

Ever stumbled across the acronyms PQ and PV and felt like you needed a secret decoder ring? You're not alone! These terms, often popping up in finance, economics, and even project management, can seem a bit intimidating at first glance. But fear not! We're about to break down the difference between PQ (Present Quality) and PV (Present Value) in a way that's, dare I say, almost enjoyable. Okay, maybe not enjoyable like eating ice cream, but definitely understandable.

Think of it this way: imagine youre baking a cake. PQ, in this scenario, is the current state of the ingredients, recipe, and your baking skills right now. Is your flour fresh? Does the recipe even make sense? Are you prone to burning things? This is all PQ. It's about the quality of everything you have at this very moment that will influence the future. It focuses on inherent attributes and readiness for transformation or investment.

PV, on the other hand, is like imagining what that cake will be worth to you tomorrow, next week, or even next year. Will it win a baking competition? Will it feed your family? Or will it just sit in the fridge, slowly hardening into a brick? PV is all about the estimated value of something in the future, but brought back to today's terms. It's a prediction, based on the quality, risk, and opportunity cost associated with achieving that future value.

Essentially, PQ influences PV. A high-quality recipe (PQ) with fresh ingredients increases the chances of a delicious, valuable cake (PV). A burnt offering, well, not so much. So, let's delve deeper into each concept to really solidify the difference.

Present Quality (PQ)

2. What Exactly is Present Quality?

Present Quality, at its heart, is a measurement of the existing condition of something. It's not just about physical properties; it also encompasses factors like skills, processes, and information. Think about a used car. Its PQ would involve its mileage, service history, the condition of the engine, and even the paint job. A car with low mileage, a meticulous service record, and a shiny coat of paint would have a higher PQ than one that's been through the wringer.

In the context of a business, PQ might refer to the quality of its products, the efficiency of its operations, the skills of its employees, and the strength of its customer relationships. A company with a strong brand reputation, innovative products, and a talented workforce would boast a high PQ. Consider a tech startup with groundbreaking technology (high PQ). Its innovative product gives it a solid foundation for future success, directly influencing its projected PV.

PQ is crucial because it directly impacts the likelihood of achieving the desired future outcomes. If the input is flawed or the process is inefficient, the output will likely suffer, reducing the potential future value. Think of it as garbage in, garbage out, but applied to everything from manufacturing to marketing.

Assessing PQ often involves thorough audits, inspections, and evaluations. It's about understanding the current state of affairs, identifying weaknesses, and implementing improvements to lay a solid groundwork for future value creation. Ignoring PQ is like building a house on a shaky foundation — sooner or later, things are going to crumble!

Present Value (PV)

3. Deciphering Present Value

Present Value (PV) is the current worth of a future sum of money or stream of cash flows, given a specified rate of return. It's a financial concept that helps us determine the value of something we expect to receive in the future, but expressed in today's dollars. Imagine someone offers you \$100 a year from now. Would you take it? Well, maybe. But what if you could invest that money today and earn 5% interest? Suddenly, that future \$100 isn't as appealing. That's PV in action!

The calculation of PV involves discounting future cash flows back to their present worth using a discount rate. This rate reflects the time value of money, which acknowledges that money received today is worth more than the same amount received in the future due to its potential to earn interest or appreciate. The higher the discount rate, the lower the present value.

PV is widely used in investment analysis, capital budgeting, and project evaluation. It helps investors and businesses make informed decisions about whether to invest in a particular project or asset by comparing the present value of expected future cash flows to the initial investment cost. If the PV of the cash flows exceeds the investment cost, the project is considered financially viable.

But keep in mind, PV calculations are based on estimations and assumptions about future cash flows and discount rates. These assumptions are subject to uncertainty and can significantly impact the accuracy of the PV calculation. So, while PV is a powerful tool, it's not a crystal ball. A dash of realism and a pinch of skepticism are always recommended!

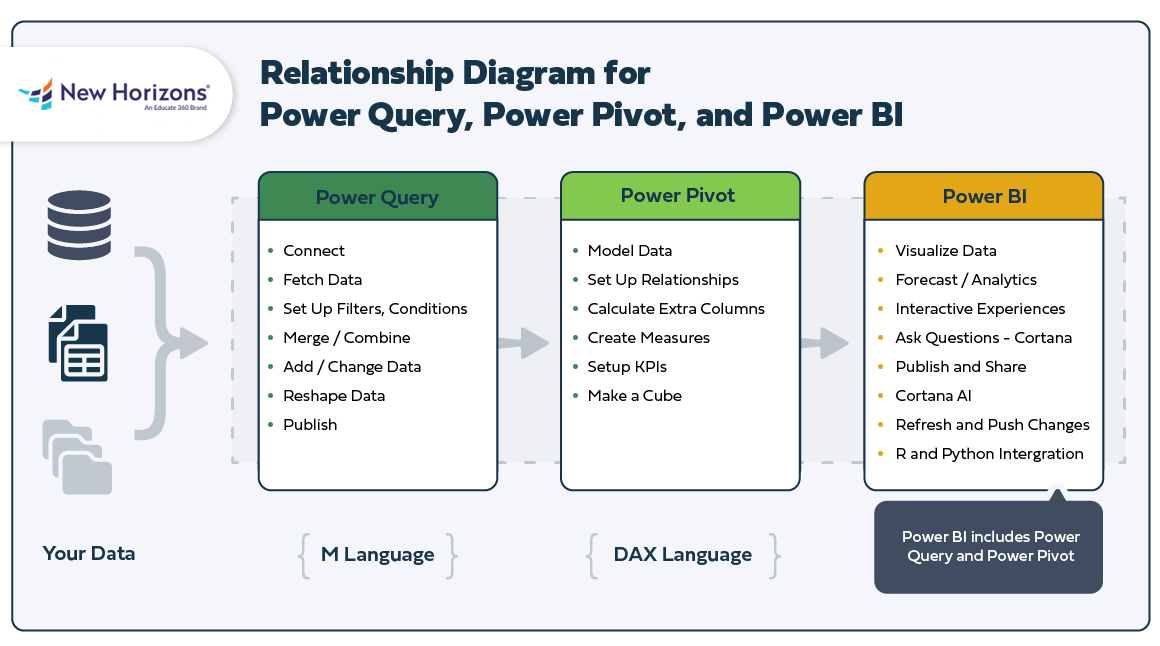

What’s The Difference Power BI, Query, & Pivot

PQ vs. PV

4. Unpacking the Core Distinctions Between Present Quality and Present Value

The fundamental difference between PQ and PV lies in what they represent. PQ focuses on the current state of assets, processes, or capabilities. It's about the now. PV, on the other hand, is a future-oriented concept that estimates the current worth of something expected to happen down the line. It's about the potential future. PQ is a qualitative assessment, while PV is a quantitative calculation.

Think of a farmer planting seeds. The PQ is the quality of the seeds, the fertility of the soil, and the farmer's planting skills. The PV is the estimated value of the crops at harvest time, taking into account factors like market prices, weather conditions, and potential pests. The higher the PQ (good seeds, fertile soil, skilled farmer), the higher the likely PV (abundant and valuable crop).

One is a tangible assessment of existing characteristics, the other is a financial projection based on those characteristics and external factors. One shapes the other; PV is directly influenced by the strength or weakness of the PQ assessment. Improve the quality, and you often increase the value.

In short: PQ is about what you have, while PV is about what you might get. PQ sets the stage, while PV tries to predict the outcome. They are interconnected but distinct concepts that are crucial for making informed decisions in various fields.

Examples in Action

5. PQ and PV

Let's see how PQ and PV play out in different situations. Imagine a software development company. The PQ would involve the skills of their developers, the quality of their coding practices, and the reliability of their infrastructure. The PV would be the projected revenue from their software products, discounted back to the present day.

Consider a real estate investment. The PQ of a property would include its location, size, condition, and amenities. The PV would be the estimated future rental income and appreciation in value, discounted to reflect the time value of money and the risks associated with the investment. A well-maintained property in a desirable location (high PQ) is likely to have a higher PV than a dilapidated property in a less desirable area.

Another example: a marketing campaign. The PQ is the quality of the creative content, the effectiveness of the chosen channels, and the skills of the marketing team. The PV is the estimated increase in sales and brand awareness resulting from the campaign, discounted to reflect the time it takes to realize those benefits. A compelling campaign that resonates with the target audience (high PQ) is more likely to generate a higher PV than a poorly executed campaign.

One final illustration: manufacturing process. The PQ would be the quality of the raw materials, the capabilities of the equipment, and the skill of the production workers. The PV would be the projected revenue from selling the manufactured goods, minus the costs of production and distribution, all discounted back to the present. In each case, a higher PQ leads to a higher potential PV.

FAQs

6. Your Burning Questions Answered

Still scratching your head? Let's tackle some frequently asked questions about PQ and PV.

Q: Is PQ always a qualitative measure?A: Not necessarily. While PQ often involves qualitative assessments (like judging the "quality" of a product), it can also incorporate quantitative measures. For instance, the number of defects in a manufacturing process would be a quantitative aspect of PQ.

Q: How do you choose the right discount rate for PV calculations?A: The discount rate should reflect the risk associated with the future cash flows. Higher-risk projects warrant higher discount rates. Common methods for determining the discount rate include using the cost of capital or the required rate of return.

Q: Can PV be negative?A: Yes, PV can be negative. This usually happens when the expected future cash flows are negative (e.g., ongoing costs) and outweigh any positive cash flows.

Q: What if you can't accurately quantify present quality?A: That's a valid concern! When precise quantification is impossible, focus on identifying key indicators and using relative scales (e.g., high, medium, low) to assess quality. Even a subjective assessment of PQ is better than ignoring it altogether.